One platform for smarter, faster CLO decisions

From holdings data, to the CLO pipeline, to scoops on the biggest people moves in the industry — we cover it all with our world-class CLO team and AI technology.

See what matters in CLO markets

Spot material developments as they happen. Our reporting helps you understand market sentiment early and stay ahead as conditions shift.

“I see content on competitor sites that I knew about two weeks ago because it was on 9fin"

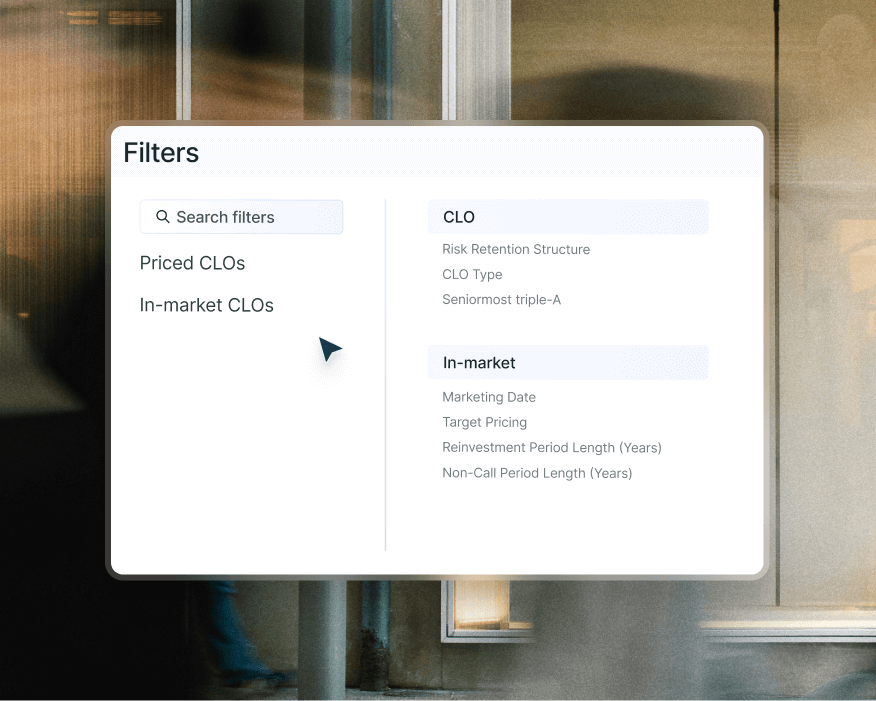

Find the right comps, fast

Use our databases to surface relevant comparable deals in seconds. Benchmark structures, understand precedent, and cut time spent searching through documents.

“9fin has now become one platform where there is no back and forth — all data is in one place now.”

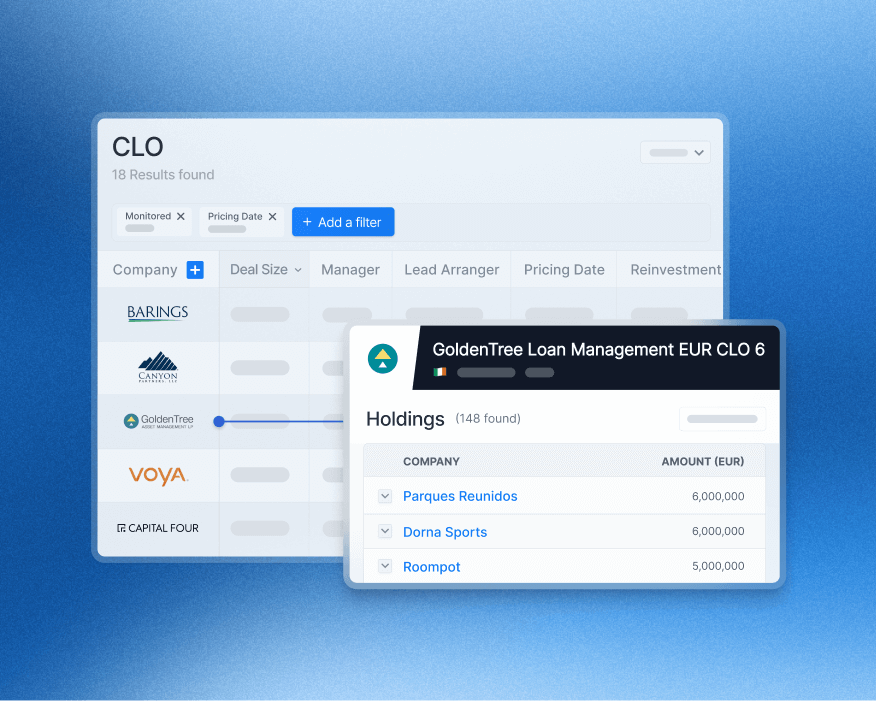

Turn demand into deals

Understand where investor demand is heading and adjust early. Track upcoming deals, trading behaviour, and market trends so you can position more effectively and move faster.

“Where 9fin is winning the market is their predictive analysis.”

Your one-stop-shop for CLO intel and data

Supercharge your workflow with AI that delivers instant insight and accelerates your most time-consuming analysis.

Instantly understand what’s market in covenants, benchmark terms across deals, and spot structural risks in seconds.

Screen over 20 years of bond and loan data with fast, flexible filtering to surface the deals that you care about.

Get timely, data-driven insight, with clear analysis that connects themes, developments, and risks.

View all borrower fundamentals — financials, cap tables, instruments, covenants, news, and analysis — in one place.

See how LMEs were structured, priced, and litigated in one place.

Instantly benchmark advisor fees across Chapter 11 cases to support or challenge cost structures with confidence.

Get the fastest alerts on price-sensitive news, filing activity, and market moves on situations you're tracking.