Be first to the situation, and best prepared

Move from signal to strategy fast with all your restructuring intel in one workflow. Access structures, LMEs, filings, and fundamentals — then dive straight into holdings, pricing, and precedent without switching tools.

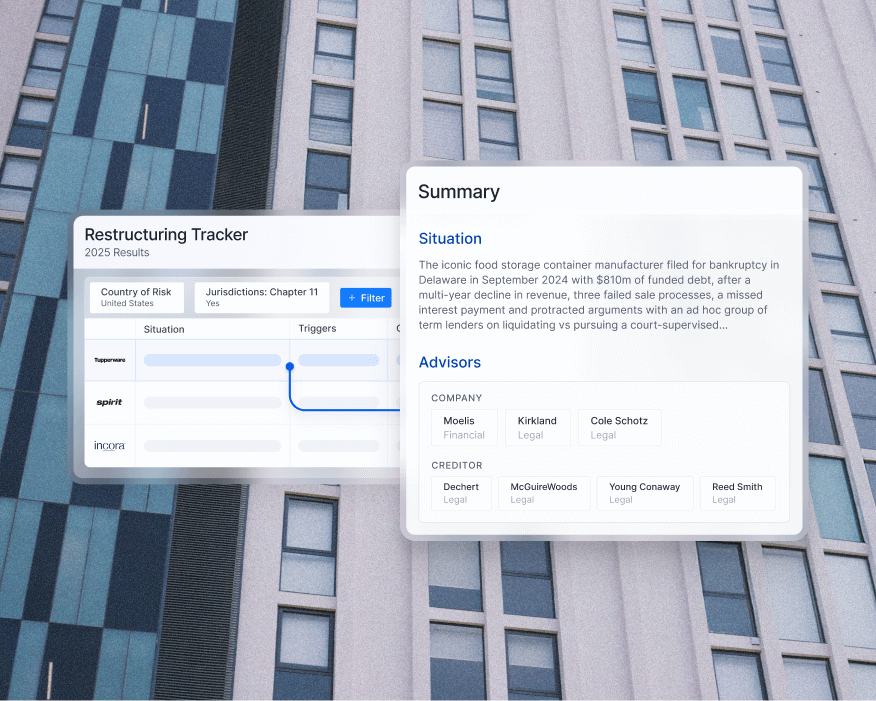

Identify early signs of stress

Spot stress early. 9fin’s restructuring tracker gives you a real-time view, including a watchlist, of ongoing restructuring situations, and our deep dives prepare you for any outcome.

“9fin’s distressed watch list is as good as the one that I saw from Greenhill and Evercore. It's up to speed and it's up to date and it has logic behind it.”

Stay ahead with real-time distressed intelligence

Follow every development with real-time distressed coverage that’s sharp, sophisticated and genuinely useful.

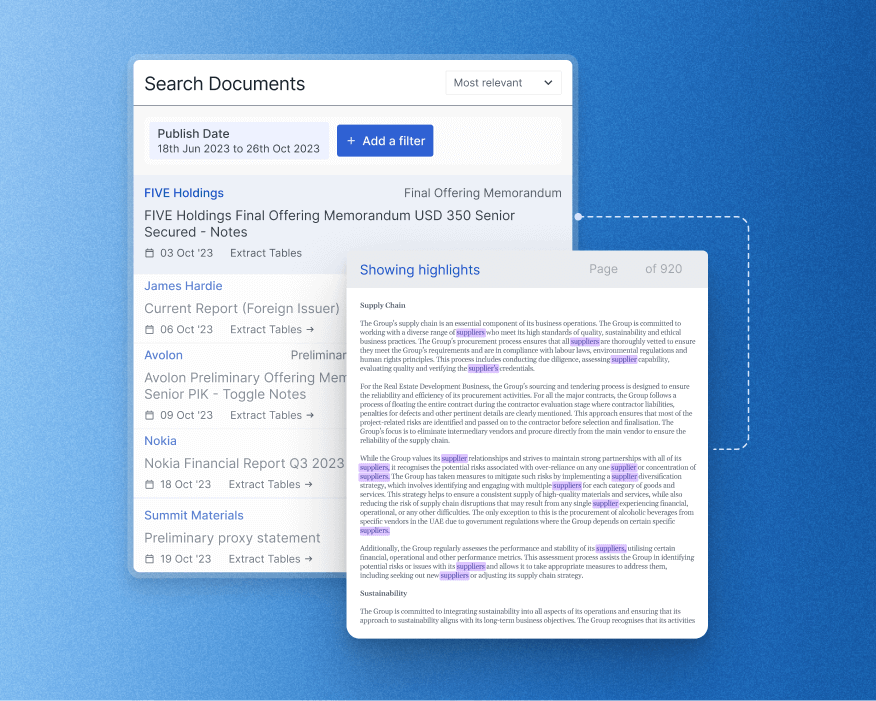

Gather pitch materials in minutes

Build sharper pitch materials in minutes. 9fin streamlines the prep work with standardized financials, accurate cap tables, and the instant access to the documents you need.

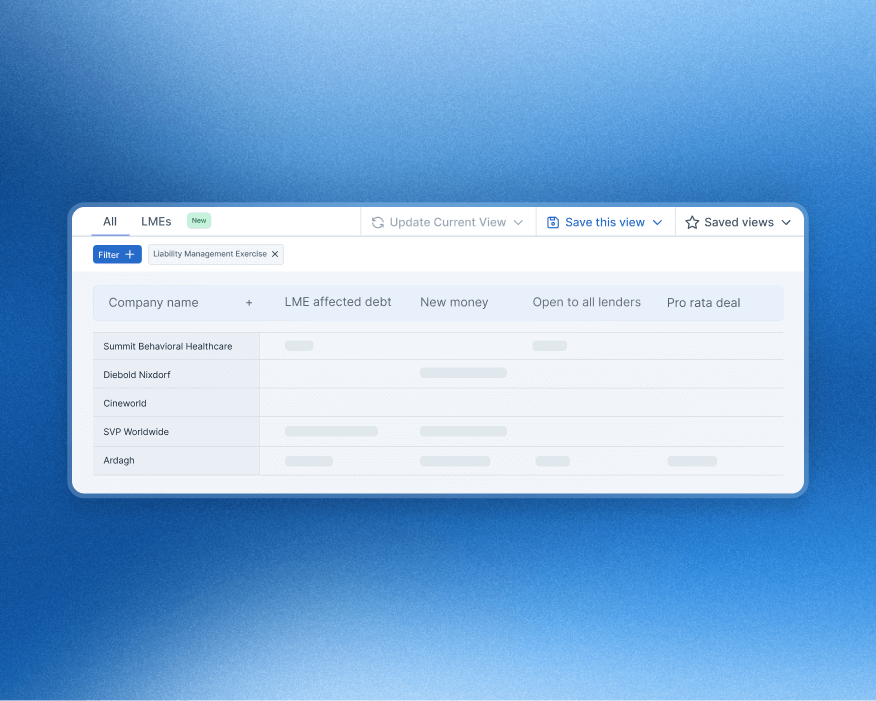

Benchmark LMEs with confidence

Shape strategy with precedent, not guesswork. Instantly benchmark LMEs across cycles. Understand what’s market, anticipate counterparty positions, and back your recommendations with hard data.

“9fin has now become one platform where there is no back and forth — all data is in one place now.”

Move from signal to strategy — in one platform

Get the fastest alerts on price-sensitive news, filing activity, and market moves on situations you're tracking.

Instantly understand what’s market in covenants, benchmark terms across deals, and spot structural risks in seconds.

View all borrower fundamentals — financials, cap tables, instruments, covenants, news, and analysis — in one place.

Supercharge your workflow with AI that delivers instant insight and accelerates your most time-consuming analysis.

Get timely, data-driven insight, with clear analysis that connects themes, developments, and risks.

Screen over 20 years of bond and loan data with fast, flexible filtering to surface the deals that you care about.

See how LMEs were structured, priced, and litigated in one place.

Instantly benchmark advisor fees across Chapter 11 cases to support or challenge cost structures with confidence.